How Marsh can help

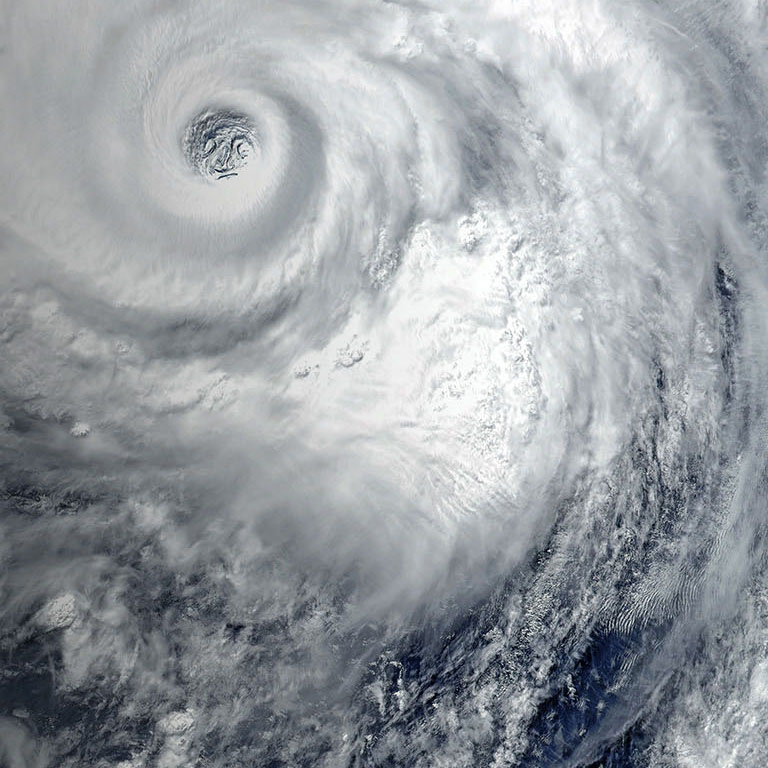

Today, companies in every sector are rapidly adapting traditional business models to improve their sustainability and reduce their impact on the climate. These developments come alongside the escalating frequency and severity of extreme weather-related events that test organisations’ resilience.

The ability to anticipate, measure, and manage risks will be a critical advantage as the transition unfolds. At Marsh, we help businesses ensure they are resilient throughout the transition: analysing the evolving risk environment, preparing for what may happen, and insuring against new types of risk.

We can provide your organisation with an environmental, social, and governance (ESG) lens on risk management, helping to deliver a competitive edge and commercial advantage. Together, we’ll build a proactive plan to support financial stability in your own company, while helping create a world that is sustainable for generations to come.